The cost of a college education is growing, but some families' income cannot keep up.

The cost of higher education is outpacing the average American family’s ability to pay, according to a 2011 College Board report titled “Trends in College Pricing.” College tuition and average family income are rising, but tuition is generally increasing at a faster rate. Although some schools, like Duke, are able to offer generous financial aid packages to offset the cost of higher education, families with lower incomes nationwide still find that more than half of their income goes toward tuition.

“The rich get richer in this winner-take-all society, and it seems tuition is being adjusted not in accordance with middle America, but rather the income of the top one in a thousand,” said Jacob Vigdor, professor of public policy and economics.

According to data from the University Archives, Duke tuition remained under 20 percent of the U.S. median family income until 1980, when tuition reached its current rate of 63 percent of the median family income. In contrast, for wealthier families, the percentage of income that is dedicated to tuition has remained relatively low and stable.

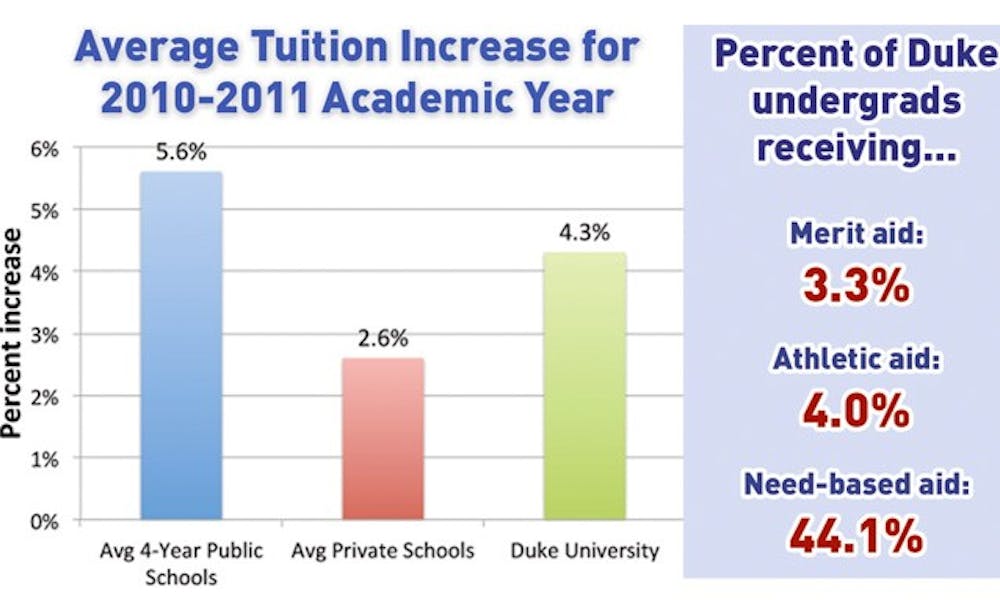

The College Board report shows that tuition rates have been rising at a faster rate among public institutions than private universities in the last decade. The average tuition and fees for students enrolled in four-year public schools for in-state students have grown by 5.6 percent beyond the rate of general inflation, compared to the 2.6 percent increase for students in private schools.

“Tuitions are increasing in the publics largely in the hopes of preserving programs and quality amid intense budget pressures,” said James Roberts, executive vice provost for finance and administration. “Higher education is more dependent on highly educated talent and is not providing the same quality services year to year. [Universities] are, we firmly believe, improving.”

Vigdor noted that elite universities offer students a variety of advantages and unique opportunities that state schools do not. He said Duke needs to focus more on the educational component of college to dispel the perception that an elite institution, like Duke, is an “academically glorified country club.”

“It is important to realize that American higher education is a complex ecosystem with many different kinds of institutions, with different systems of control and funding and different missions—the biggest distinction is between [public and private universities],” Roberts said.

Covering the cost

With tuition costs on the rise nationally, Duke is not immune to the trend.

Duke’s undergraduate tuition rose 4.3 percent to $40,665 for the 2011-2012 academic year. Tuition hikes are driven primarily by improvements in education, such as investing in faculty members, Vigdor said.

“[Top universities] provide an education that costs a great deal more than they charge in tuition,” Roberts said.

Although the median family income has been increasing over time, income is increasing at a slower rate than the cost of higher education. The College Board report indicates that the average income was lower at all socioeconomic levels in 2010 than it had been a decade earlier—with the income of the bottom 20 percent of families decreasing by 16 percent.

As such, tuition increases can affect subsets of students disproportionately, Vigdor said.

“It is worrisome that Duke sends a message to the world that anyone can afford Duke but increases their tuition to levels that make very bright students from middle-class families throw their hands up and give up,” he said.

A financial commitment

For some families, affording college can be offset by grants, loans and work-study.

In 2007, Duke revamped its financial aid to eliminate the parental contribution for families with total incomes of less than $60,000 per year and eliminated loans for families with incomes less than $40,000. The changes also reduced loans for families making more than $100,000 per year.

According to the Duke Financial Aid website, 44.1 percent of enrolled undergraduates receive need-based grant aid.

Indeed, a Duke junior, who requested anonymity, said the perception that Duke is comprised entirely of wealthy individuals is incorrect, adding that she knows many people who would not be here without their aid packages. She said she can attend Duke primarily because she receives financial aid.

“On top of the normal college stresses of asking, ‘Where will I go?’ I was worried... if I could go,” she said. “Now, I am essentially paying nothing to come here, and I will graduate Duke debt-free.... I can be here without distractions.”

Roberts said Duke’s financial support has grown at more than twice the rate of the increase in cost of attending in order to respond to the growing need of students.

“The percentage [of students demonstrating need] has risen over the last several years, and we’ve made meeting our commitments to our financial aid program a top institutional priority even as other budgets have been constrained,” Roberts said.

The rising cost of tuition has served as a form of wealth redistribution by placing the financial burden of tuition more heavily on the shoulders of those who can theoretically bear it, Vigdor said. The price discrimination stems from varying financial aid packages, making it unlikely that any two students in the same class pay the same amount for Duke.

“We can do this because we have an exclusive product that people will want for a long time,” he said. “Coca-Cola would love to charge rich people $20 for a bottle of coke, but they can’t because there is no [Free Application for Federal Student Aid] for soda. It is a business model everyone wants, but we can get away with because we know our customer’s ability to pay.”

Get The Chronicle straight to your inbox

Signup for our weekly newsletter. Cancel at any time.