A year after the Board of Trustees approved changes to Duke's policies on socially responsible investing, the University continues to work on increasing transparency in its investment committee system.

The Advisory Committee on Investment Responsibility—a group of faculty, trustees, alumni and students who assess the social impact of Duke's investments—is finalizing the transition to a new structure intended to increase both internal regulation and external transparency. After being reorganized by the Board's vote last October, the group is aiming to make information on socially responsible investing more accessible.

The committee's restructuring comes in the midst of several student-led movements for socially responsible investing—including the successful 2012 push to divest from conflict minerals, last year's Duke Open campaign for endowment transparency and the current Divest Duke movement to divest from fossil fuel companies.

"We're supposed to be more active, rather than just being reactive," said ACIR Chair James Cox, the Brainerd Currie professor of law. "We're supposed to have a way of surveilling events and getting ahead of the curve—or at least, not falling woefully behind the curve."

Before the Board's decision last Fall, ACIR met irregularly on an ad-hoc basis and was a secondary committee, only seeing investment issues after they had been presented to the President's Special Committee on Investment Responsibility. The Board decided to dissolve the President's Special Committee, making ACIR the principal adviser on socially responsible investments.

The group now has a regular meeting schedule—five to six times a year—and has expanded from 10 members to 14 so as to better reflect the University community, Cox said.

Cox noted that the transition to a larger group with regular meetings has gone smoothly, adding that ACIR is in the process of adopting internal bylaws to finalize the restructuring. The committee now turns its focus to more external action—increasing transparency and fine-tuning its guidelines as it considers the proposal by Divest Duke.

To improve access to information, ACIR launched a website this week to share its policies and facts on socially responsible investing. The group held a public forum Monday in Perkins Library, discussing ACIR's role with the endowment and fielding questions on the logistics of divestment.

The road ahead regarding divestment, however, is more nuanced.

"Our committee has a range of things that we might do, and the nuclear option of that—really, I say nuclear—is divestment," Cox said at the forum. "Because, as you can well imagine, that has some repercussions."

Morality and ethics cannot be the only guiding principles in deciding where Duke should invest its endowment, said Associate University Counsel Ralph McCaughan, an ex officio member of ACIR. In order to justify divestment, DUMAC—the professional group which manages the University's endowment—must be able to identify substitute investments that will yield equal returns with an equal risk, he said.

"It's clear that under the law, the Board of Trustees is obligated to optimize the returns of the endowment," McCaughan said. "They have certain parameters within which they have to operate. Doing the right thing from a moral standpoint is not necessarily the rule they have to follow."

The process is further complicated by the fact that direct divestment does not mean complete divestment, Cox noted. Even if the University were to divest from fossil fuels, for instance, there would likely still be companies in Duke's portfolio that invest in fossil fuels themselves—raising questions of what it really means to divest, Cox said.

"It's really a strange process," he noted. "It's kind of like whack-a-mole."

This makes divestment largely a symbolic issue, Cox said. But being rooted in the abstract rather than the practical does not make it less important, he said, adding that divesting from fossil fuels is a particularly interesting proposition as the University pushes toward becoming carbon neutral. He noted the deep symbolism of steps Duke has taken toward the goal of carbon neutrality, including converting the campus steam plant from coal to natural gas.

"If we're talking about symbolism, this is symbolism with a capital 's,' underscore, bold print," Cox said of the transition away from coal.

Further contributing to the idea that divestment is more symbolic than functional is the fact that only a small portion of the University's endowment falls under ACIR's jurisdiction for socially responsible investment, Cox noted. The committee makes recommendations about the endowment's direct investments in equities—a small fraction of the University's holdings.

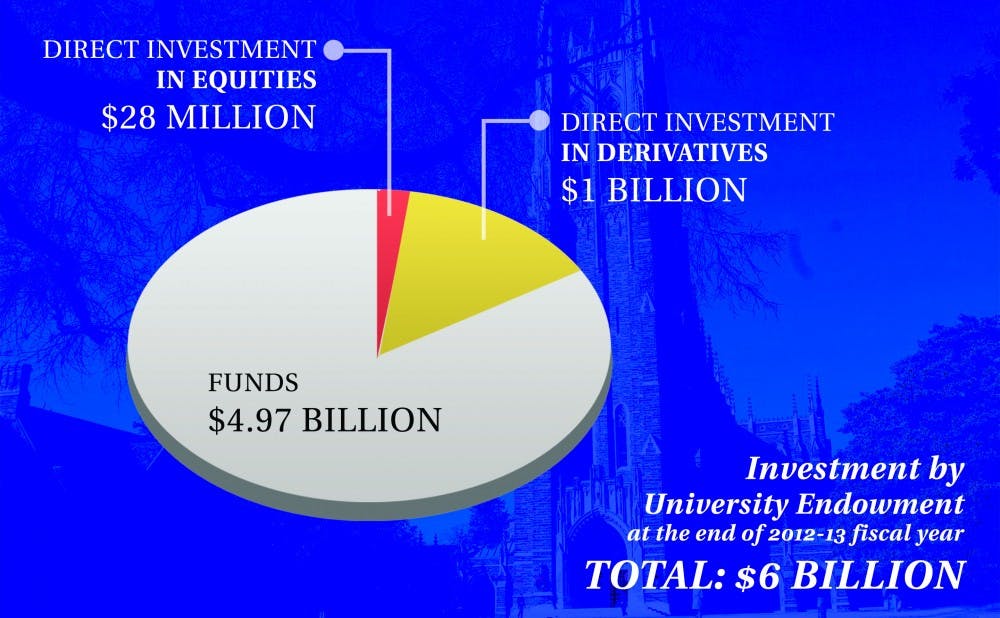

For the 2012-13 fiscal year, $28 million of the endowment's $6 billion came from direct investments in equities.

Cox noted that although the majority of the endowment is not under ACIR's purview, "it's not hidden under the rug." Just under $5 billion is handled by individual managers selected by DUMAC who invest in various funds—including venture capital funds and start-up funds—and the remaining $1 billion is directly invested in derivatives, which are higher-risk but allow for greater movement, Cox said.

Monday's forum was sparsely attended, with fewer than 10 attendees who were not ACIR members. The few who came, however, were vocal.

Dr. Richard Frothingham, associate professor in the Department of Medicine's Human Vaccine Institute, handed ACIR members packets of coal—as both a symbol of how far Duke has come with environmental initiatives and a push to move forward.

"May this coal serve as a reminder of the progress Duke has made toward energy sustainability and as an impetus for future progress," Frothingham said.

Cox noted that although navigating divestment is complicated, sparking conversation on the topic—through the forum, through ACIR's website and restructuring and through general campus discourse—is almost always a positive thing.

"This is a university, this is not a plantation," Cox said. "And the difference between the two is that a university is a place of engagement."

This article was updated Oct. 8th to reflect additional information about James Cox's remarks at the forum.

Get The Chronicle straight to your inbox

Signup for our weekly newsletter. Cancel at any time.