Whether or not a scandal surrounding a major Duke donor will affect the University still remains a question.

In light of allegations that Aubrey McClendon, co-founder and CEO of Chesapeake Energy Corp. and Trinity ’81, engaged in unethical business practices, McClendon will step down as the company’s chairman, but he will retain his position as the CEO and a board member. Although McClendon has donated more than $16 million to Duke to date, University officials are, by and large, staying silent.

McClendon, Stephen Bayer, associate vice president of development, and William Conescu, executive director of development communications, all declined to comment.

“Each situation is different, and nonprofit organizations like Duke will typically look at the facts, not speculation, to inform their decision-making,” Michael Schoenfeld, vice president of public affairs and government relations, wrote an email Wednesday.

An April report from Reuters detailed how McClendon borrowed $1.1 billion over the past three years to participate in the Founder Well Participation Program, which allowed him to take out loans against his personal stakes in the Chesapeake Energy Corp.’s oil and gas wells.

The Securities and Exchange Commission launched an inquiry into the loans April 18. Chesapeake is currently the second-largest natural gas enterprise in the United States, accounting for 5 percent of U.S. natural gas production, giving the corporation significant influence over the market.

A shareholder filed a lawsuit against McClendon, Chesapeake and members of the company’s board of directors in the U.S. District Court of Oklahoma City April 19.

Additionally, McClendon co-founded and managed Heritage Management Company LLC, a $200 million private hedge fund, from 2004 to 2008. The fund traded the same commodities that Chesapeake produces. It is unclear whether he received permission from the Chesapeake board to run the hedge fund, and there is currently no evidence that McClendon used inside knowledge from Chesapeake in his trading at Heritage.

Such actions raised concerns about conflict of interest regarding McClendon’s leadership of the company versus his own personal interests.

“If McClendon has $1 billion in debt through his own companies... whose interest will he look out for, his own or Chesapeake’s?” said Joshua Fershee, an associate professor of energy and corporate law at the University of North Dakota, in an interview with Reuters.

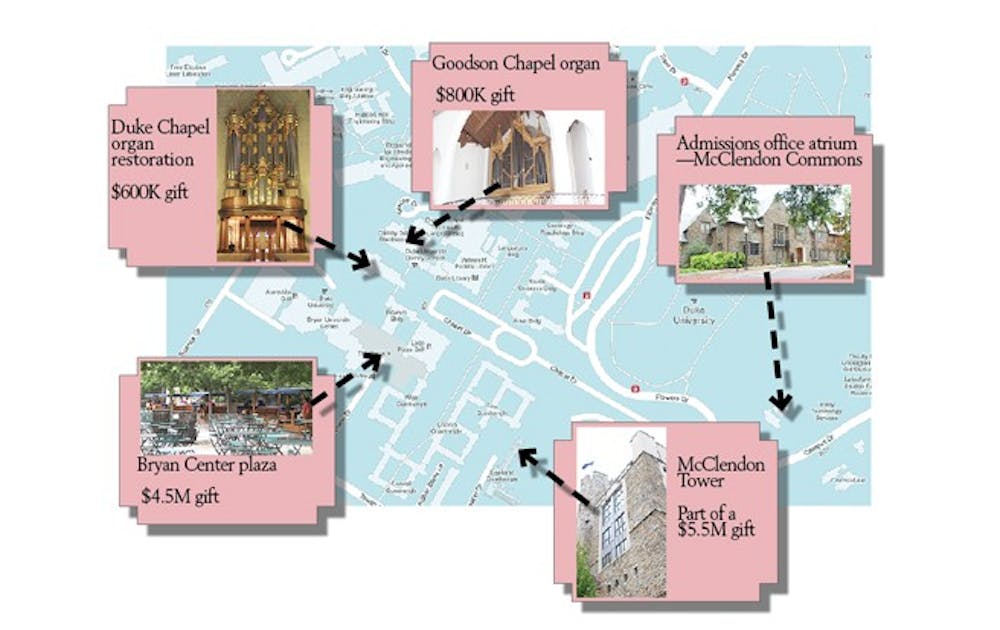

McClendon’s donations have contributed to many significant projects such as McClendon Tower, the Bryan Center Plaza and the Divinity School Chapel.

When faced with situations where major donors are accused of engaging in questionable business practices, large organizations are primarily concerned with preserving their reputations and maintaining financial stability, said Chris MacDonald, senior fellow at Duke’s Kenan Institute for Ethics and associate professor of philosophy at Saint Mary’s University.

Nonprofit institutions—including universities like Duke—should be wary of the risks associated with accepting donations that could jeopardize their reputations.

“The decision makers at a university have their responsibilities to the students, other donors and alumni,” MacDonald said. “It’s a pragmatic matter of responsibilities to the university community.”

He noted that predicting reputation risks is very difficult, pointing to the unexpectedness of the accusations against McClendon.

It remains to be seen how the University should ethically respond to McClendon’s past donations, MacDonald added. Whether or not McClendon faces further legal consequences remains uncertain, as he is still in the midst of an inquiry by the Securities and Exchange Commission.

Although some may wonder how these developments reflect on McClendon’s past gifts to Duke, MacDonald said he does not believe the University needs to return the donated money, given that the money was not procured through criminal activity.

“The fact that McClendon himself is facing accusations doesn’t seem to be sufficient reason to necessitate giving back the money,” MacDonald said.

Large institutions such as Duke should adopt a more proactive approach to safeguarding their reputations, MacDonald added. By establishing policies that allow the organization to dissociate and distance itself in cases of liability concerns, these institutions are serving their respective communities.

“Universities should be careful to have provisions that give them the option to dissociate themselves,” MacDonald said. “Ethically, organizations should be thinking about that ahead of time.”

Jack Mercola contributed reporting.

Get The Chronicle straight to your inbox

Signup for our weekly newsletter. Cancel at any time.