The Department of Education’s student loan suspension program is set to expire in the coming months, meaning interest and repayments on federal student loans will resume for the first time in over three years. Interest will begin accumulating on federal student loans on Sept. 1, while payments are set to restart in October.

The Supreme Court struck down a debt relief initiative that offered up to $10,000 in student debt forgiveness for non-Pell Grant recipients and up to $20,000 for Pell Grant recipients in a June decision.

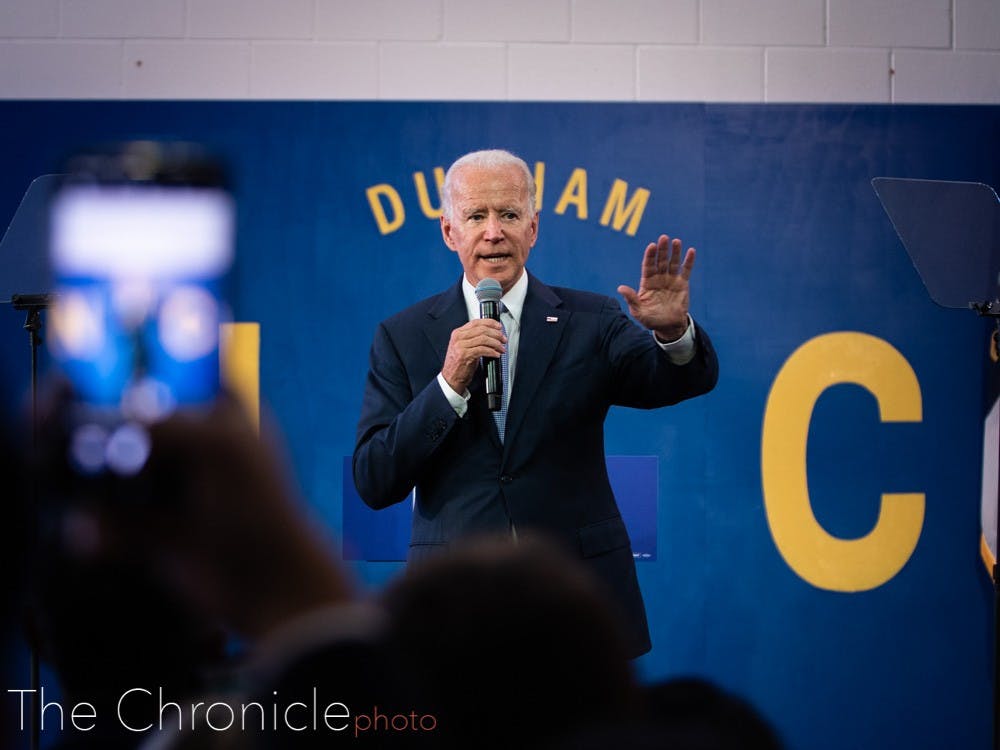

In response, the Biden administration announced several new programs to provide student debt relief.

The Department of Education announced in July that it would cancel $39 billion in federal student loans for 804,000 borrowers under existing income-driven repayment (IDR) plans. Under the loan forgiveness program, borrowers are eligible for forgiveness if they have made 20 or 25 years of monthly payments under an IDR plan.

IDR plans adjust borrowers' monthly payments based on their income and family size, potentially lowering borrowers’ financial burden.

The Biden administration also launched an early beta application for the Saving on a Valuable Education plan, a new IDR plan which borrowers with direct federal loans qualify for. Borrowers are eligible to sign up this summer before payments resume in October.

The SAVE plan comes in two phases, with the first phase launching in the coming months and the second rolling out in 2024. This year, borrowers under the SAVE plan will see the income exception rise to 225% above federal poverty guidelines and will not be penalized with growth of unpaid interest so long as they make their principal payments on time. Married couples who file their taxes separately will not need to include spousal income in calculations.

Nearly 44 million people currently have federal student loans, amounting to a nationwide outstanding federal student loan debt of $1.64 trillion. Almost 27 million federal loan borrowers currently have their loans suspended.

As of August 2022, about 30% of Duke undergraduates take out student loans. The average student debt for those students was $24,219. As of March, the median debt when all Duke students graduate was $13,500, below the national average.

Get The Chronicle straight to your inbox

Signup for our weekly newsletter. Cancel at any time.

Jazper Lu is a Trinity junior and managing editor of The Chronicle's 119th volume.