A slew of American universities released fiscal year 2018 endowment figures in the past several weeks, including Duke, whose endowment returned a 12.9 percent growth to a record $8.5 billion dollars.

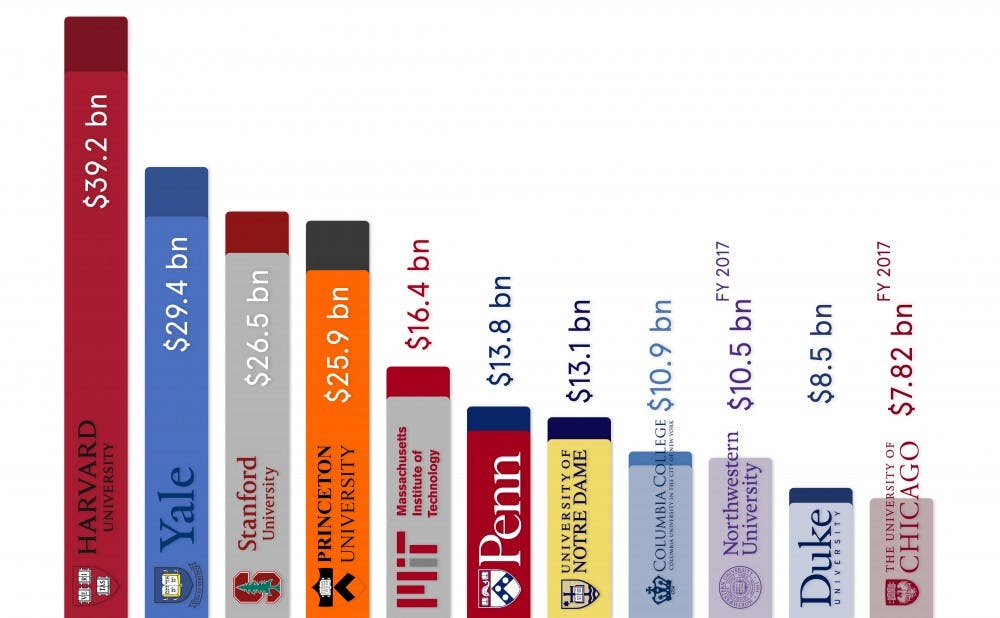

The growth marginally outpaced Duke’s 12.7 percent growth in the previous year. Managed by the Duke University Management Company, known as DUMAC, the Duke Endowment is the 10th largest private college endowment in the United States this year, and Duke’s 2018 growth was tied with the University of Pennsylvania for third among the top 10 endowments.

Michael Schoenfeld, vice president of public affairs and government relations, said that the expanding endowment is the result of DUMAC's hard work.

“Obviously, DUMAC had a very good year," Schoenfeld said. "We had very smart and strategic investment managers in DUMAC, and having an endowment that grew at 12.9 percent last year will continue to provide Duke with a level of financial support and infrastructure that will make it possible to continue to do important things like expand financial aid, endow professorships and support programs.”

Indeed, the Duke Endowment far outgrew the 8.3 percent median return attained by a wide range of US college endowments this year, according to preliminary data from Cambridge Associates. Among the top 10 private college endowments, only Princeton and the Massachusetts Institute of Technology had higher returns.

The Duke Endowment’s 2018 returns also beat the 8.4 percent gains that a typical 60-40 portfolio of S&P 500 stocks and aggregate bond index investment grade bonds would have returned in fiscal year 2018, according to Markov Processes International. The endowment’s growth also surpassed the S&P 500’s 10.8 percent growth over the same period.

The endowment includes around 5,200 funds as of June 30, according to a snapshot of the endowment released by Duke. Long-term targets for investment are 48 percent invested in equity, 15 percent invested in credit and the remaining percentage doled out among commodity, real estate, rates and more.

"Diversification across investment exposures is central to generating strong investment returns while moderating portfolio risk and volatility," the report reads.

Spending from the endowment is divided into several pools, with 21 percent devoted to financial aid, 19 percent to professorships and 10 percent to instruction and research. Another 27 percent is devoted to the "unrestricted support of the university or one of its schools or budget centers," according to the report.

Schoenfeld declined to comment on specific asset allocations.

One of the most significant uses of college endowments is financial aid, and colleges have been increasingly vying to provide better financial aid packages to attract the best students from around the world.

“Over the years, Duke has continued to increase and expand opportunities for financial aid,” Schoenfeld said. “Affordability and access are very important to this institution.”

Many universities with smaller endowments—such as Amherst College, Brown University and Davidson College—only provide no-loan financial aid packages. Rice University, with a $5.5 billion endowment, announced in September that it will begin offering full-tuition scholarships to undergraduates whose families earn less than $130,000 a year, with students whose family incomes are lower than $65,000 also receiving grants covering the total costs of room, board and fees.

“How [financial aid] gets done is really highly specific to every institution, but in recent years, we have significantly reduced the amount of loans that are in financial aid packages,” Schoenfeld said.

Regarding the potential for increased endowment funds towards financial aid, Schoenfeld noted that Duke cannot repurpose donations towards financial aid if they were initially endowed for other purposes. In fact, even the investment return on a gift “has to be used for the purpose for which [the gift] is designated.”

Therefore, Duke’s fundraising priority has been to raise money for financial aid endowments to lessen the burden of financial aid on the operating budget, he said.

Although the endowment’s 2018 performance is encouraging for the University, plans to improve Duke’s financial aid with endowment funds may be hindered by the 1.4 percent endowment tax legislated this year in the Bipartisan Budget Act of 2018.

“We expect we will be impacted eventually, but it’s unclear because the rules have not been confirmed yet,” Schoenfeld said. “There’s going to be less money that goes to financial aid, there’s going to be less money that goes to scholarships, there’s going to be less money that goes to maintaining the infrastructure, and that’s just contrary to everything that both an endowment and public policy towards education should stand for.”

Get The Chronicle straight to your inbox

Signup for our weekly newsletter. Cancel at any time.