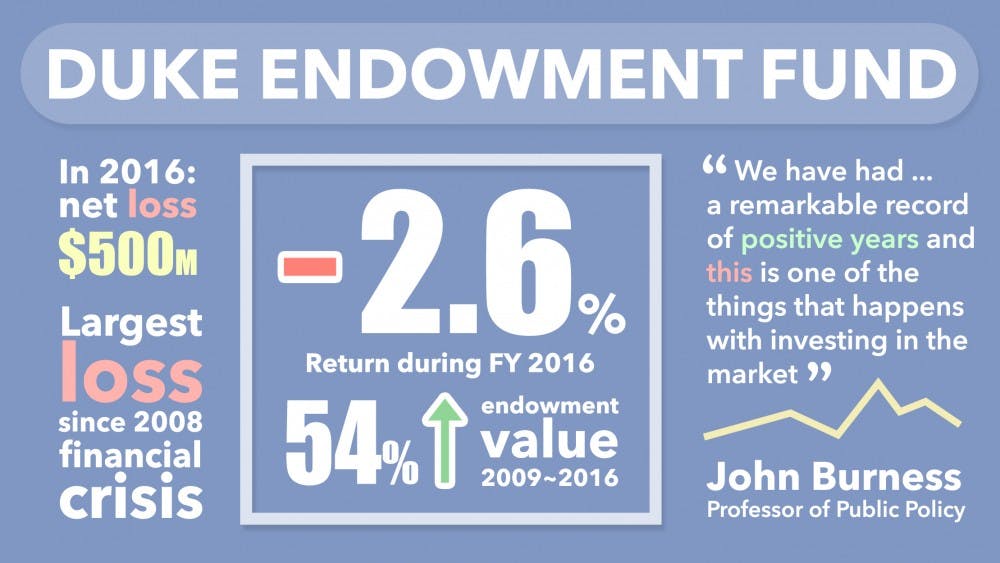

Although GPAs may have gone through the ringer this semester, students may take solace in the fact that the Duke endowment has experienced some of its own tribulations recently as well, posting a 2.6 percent loss on its investments during the 2016 fiscal year.

Overseen by DUMAC, Inc.—the professional organization that manages the University's investments, including employees’ retirement pool and its health system's investments—the endowment's value was $4.4 billion in 2009, $7.3 billion in 2015 and $6.8 billion in the fiscal year that ended this June. Although the recent drop may seem insignificant compared to gains during the past several years, it was the largest decrease since the 2008 financial crisis and represented a net loss of $500 million, an approximately seven percent decrease in the endowment's value.

Despite this news, John Burness, visiting professor of the practice in the Sanford School of Public Policy and former senior vice president for public affairs and government relations, said that he does not think people need to be worried.

“It’s serious on one level because you always want to be positive, and it means we're paying out a little over four percent," Burness said. "But I don’t think that people should overreact to it at all; it’s one year. We have had really quite a remarkable record of positive years and this is one of the things that happens with investing in the market."

Burness added that this loss was small compared to the financial crisis in 2008.

“This is not like 2008 where the University had to find a hundred million dollars," he said. "It’s a much smaller amount of money."

Michael Schoenfeld, vice president for public affairs and government relations, said he anticipates little impact for students and faculty as a result of this loss, citing DUMAC’s long-term outlook.

“In 2009, during the financial crisis, the value of the Duke University endowment declined by 25 percent, but because we used an average [disbursement amount from the endowment] over the previous three years—rather than annually—the difference from year to year of what was going to impact student life was significant, but not catastrophic,” Schoenfeld said.

Duke was not the only University whose endowment experienced a loss, as more than 430 endowments reported an average of 2.7 percent loss in the 2016 fiscal year. Strikingly, the value of Harvard's endowment dropped $2 billion during the same time period and its former endowment chief step down in July.

Financial experts cited several reasons why the funds may be going through tough times.

“Part of the difference in why the endowment has incurred a loss—whereas if you look at the S&P 500 there would have been a slight gain—is because endowments are longer-term investors. Not only can they take on more risk, but they can invest in different asset classes,” said Elisabeth de Fontenay, an associate professor of law who specializes in corporate law and finance. “All of these things have a different risk profile than just stocks of publicly traded companies."

Charles Clotfelter, Z. Smith Reynolds professor of public policy studies, expressed a similar sentiment, noting that endowments of major institutions often feature similar variations year to year.

"If they start putting ramen soup in the new dining hall on West Campus, then the students need to start worrying,” he added jokingly.

Get The Chronicle straight to your inbox

Signup for our weekly newsletter. Cancel at any time.