Despite growth of the University’s long-term investments in the 2010 calendar year, spending for next fiscal year will not substantially increase.

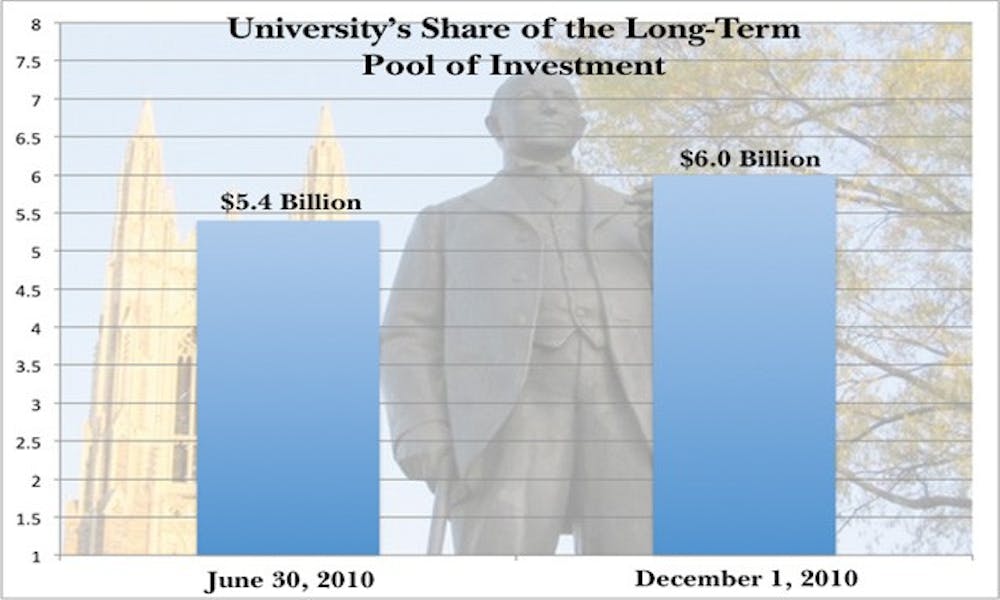

The University’s share of the long-term pool of investments, which is managed by the private firm Duke University Management Company, saw 13.3 percent growth in 2010, Vice President of Finance Tim Walsh said. The increase has brought the current valuation of the investments to $6.0 billion, up from June 30 of last year when it was valued at $5.4 billion. Walsh noted that those figures do not include other funds managed within the long-term pool, including those of the Duke University Health System and other agency funds.

“From where we started in July 2008, would I have expected two calendar years of [these returns]? No, our models were showing 5 percent, or 8.5 percent,” Executive Vice President Tallman Trask said. “In part that’s because I didn’t want to overestimate before the fact.”

Even with the rise, the University is still yet to reach the level it was at before the economic recession. Trask added that the overall annual return since summer 2008 is still negative, standing at about -1 or -1.5 percent, he estimated.

“It’s better than I expected, but we’re not back to where we were,” Trask said.

Because not all universities have released their 2010 numbers, Duke has not been able to compare itself to other institutions, Walsh said. He added that the most recent numbers should put Duke in the top quartile as usual.

Starting next fiscal year, some faculty members will benefit from the economic gains. In the Fall, President Richard Brodhead announced plans for a “modest salary increase”—a measure that Duke has not taken in two years—beginning next fiscal year. Trask said the positive growth last year reaffirmed the upcoming salary increases, although he noted that it is still “too early to tell” their exact size. The increases will likely be lower than they were prior to the economic recession, he noted.

“[Increases before the recession] were in the 2, 3, 4 [percent] range, this will be in the 2, 3 [percent] range, I would guess,” he said. “We have a lot of work to do.... We are working hard to figure out how to pay for [the salary increases] again.”

But because the University has not been able to revert back to pre-recession practices, endowment distributions will be flat for the 2011-2012 fiscal year, Trask reported. This is partially because the University’s budget deficit has yet to be completely eliminated. In Spring 2009, the University announced that it faced a $125 million budget deficit—which was later recalculated to be closer to $100 million—that it would have to eliminate over the next three years.

Last year, administrators announced that the deficit had been reduced to approximately $40 million, which they planned to eliminate over the course of this year and next year. Although Trask emphasized that it is hard to calculate the current status of the deficit, he said some models place its current value at or below $20 million.

“The problem is that there are a thousand moving parts... and some are up and some are down,” he said. “We are certainly better off than we thought we were going to be... but I am not going to declare we are over. We are in a new equilibrium, but that equilibrium does not provide us with much, if any, investment capital.”

Walsh said that the reduction of the budget deficit—which should be complete by the end of fiscal year 2012—is “roughly on schedule.”

“While we are on schedule to eliminate it, there is clearly some more focus that is needed,” Walsh said.

The Board of Trustees will discuss plans to eradicate the remaining portion of the deficit at its meeting at the end of the month.

When first faced with the deficit, the University initiated early retirement programs and worked to eliminate the equivalent of about 400 positions. Trask said most of those efforts are over, pending another dip in the economy.

Although he noted that administrators plan to “push down some expenditures,” Trask said many of the future cuts will come through a more efficient method of ordering University resources, known as eProcurement. Some departments in the School of Medicine and the Pratt School of Engineering are currently running pilot tests of the procurement software program, which utilizes contracts that offer lower prices.

The program—which will go live across the University later in the Spring—could save up to $30 million a year. Trask noted that he is not certain that the savings would be that large, however.

Although he mentioned that the University will not need to eliminate more positions, it is currently working on reducing expenditures in certain areas of the University, particularly the media department. He added that some publications and websites may have to be eliminated to cut costs.

Going forward, Trask and Walsh emphasized that the University is being conservative in how it chooses to allocate funds. Because University officials remain fearful of the economy’s instability, Walsh noted that the University has maintained “an almost static endowment spending rate”—something that other universities have had to adjust.

“In general, I think we have done a reasonably good job in solving most of the problem, and the rest of the problem—at some level—is being solved by the economy, but I am not willing to bet yet that that part of the deal is going to stick,” Trask said.

Get The Chronicle straight to your inbox

Signup for our weekly newsletter. Cancel at any time.