Students who apply to Duke must decide whether to check a box on their applications indicating whether they intend to apply for financial aid.

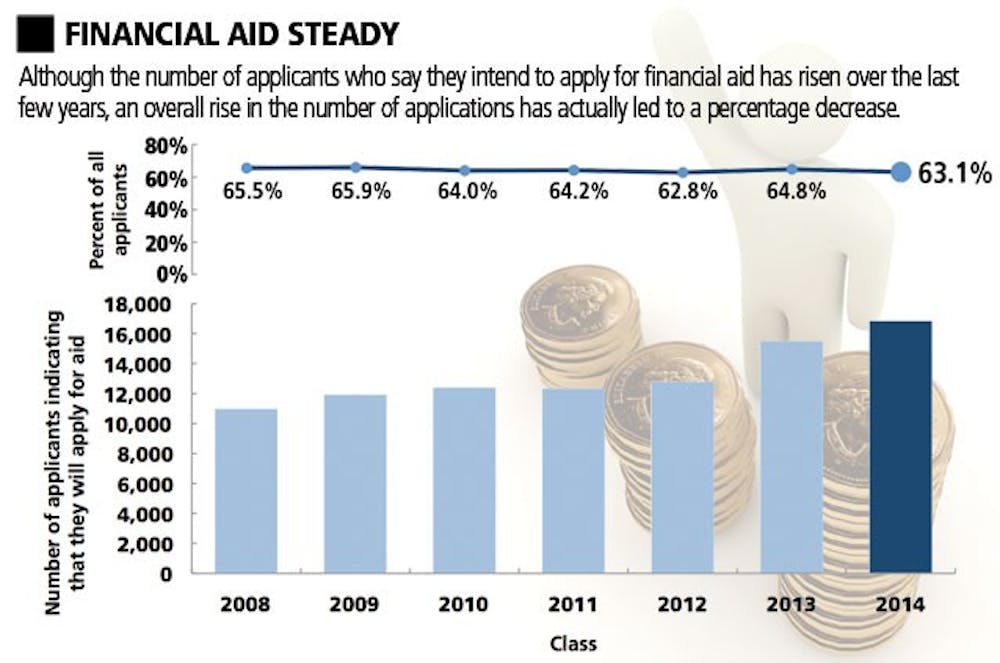

The past three years have seen the University enact a major overhaul of financial aid policies in December 2007 and cope with the impact of a national recession in the fall of 2008. Yet, the percentage of applicants checking that box has remained relatively steady. Since 2003, this number has fluctuated between 62 and 66 percent, according to data provided by the Office of Undergraduate Admissions, catching administrators by surprise.

“It surprised me last year and it surprised me this year. I would have suspected that the percentage would have increased,” said Dean of Undergraduate Admissions Christoph Guttentag.

Although it remains unclear why the percentage of applicants expressing an intent to apply for aid has remained so consistent, Guttentag said one possible explanation is the discrepancy between the number of people indicating interest in aid and the number who actually apply. It may be possible that the percentage of applicants in each class applying for aid has actually increased over the years, he said.

Despite requests for further data on the number of applicants who do apply for need-based aid and the respective financial need of those applicants, Nerissa Rivera, a financial management analyst at the Office of Undergraduate Financial Aid Office, said she was not authorized to release that information.

Over the past few years the total number of undergraduate need-based aid recipients has ranged from 2,484 in 2003-2004 to 2,605 students last year, according to data provided by Rivera. Duke’s undergraduate student body usually numbers around 6,500.

The University has adopted a strategy of encouraging students to apply for aid regardless of their perceived eligibility, Guttentag noted.

“We’ve always told people that there’s no harm to applying for financial aid and that it can only be beneficial,” Guttentag said. “That message has come across.”

Provost Peter Lange said the economic situation may have resulted in an increase in financial need rather than an increase in the number of people applying for aid.

Alison Rabil, assistant vice provost and director of Financial Aid, confirmed Lange’s sentiment, noting that the Class of 2013 has experienced a steep increase in need, probably due to the economic crisis. She added that there has also been a steady increase in financial need every year.

“[Financial need] just keeps going up. We have more students who are on aid and those students need more than they needed before,” she said.

Rabil also said the Class of 2013 received more grant money than in past years, and that the amount of the average grant is going up. Total University grant resources have increased steadily from $42.1 million in 2003-2004 to $65.1 million last school year, according to data provided by Rivera.

Despite administrative expectations, students like Matt Ordway, an incoming freshman from Stamford, Conn. who was accepted early decision, said the economic downturn and new financial aid policies were not a deciding factor in applying for aid.

“I was going to apply either way, as there is no reason to not try and get financial aid—you never know what will happen,” he wrote in an e-mail.

Lange noted that new financial aid policies are not likely to create a significant change in the number of financial aid applicants.

For accepted early decision applicant Ryan Kane of Ocala, Fla., however, Duke’s new aid policies were an important factor in his decision to apply for aid.

“I applied [for aid] knowing that I would only be able to attend Duke if the financial aid policies that were in the literature were actually true... I was motivated by the fact that Duke basically promised that if I got in I would be able to afford attending one of the top colleges in the world,” he wrote in an e-mail. “It was pretty cool finding out that Duke actually keeps that promise.”

Get The Chronicle straight to your inbox

Signup for our weekly newsletter. Cancel at any time.