The value of homes sharply declines when fracking takes place in neighborhoods, according to a new Duke study published in the American Economic Review.

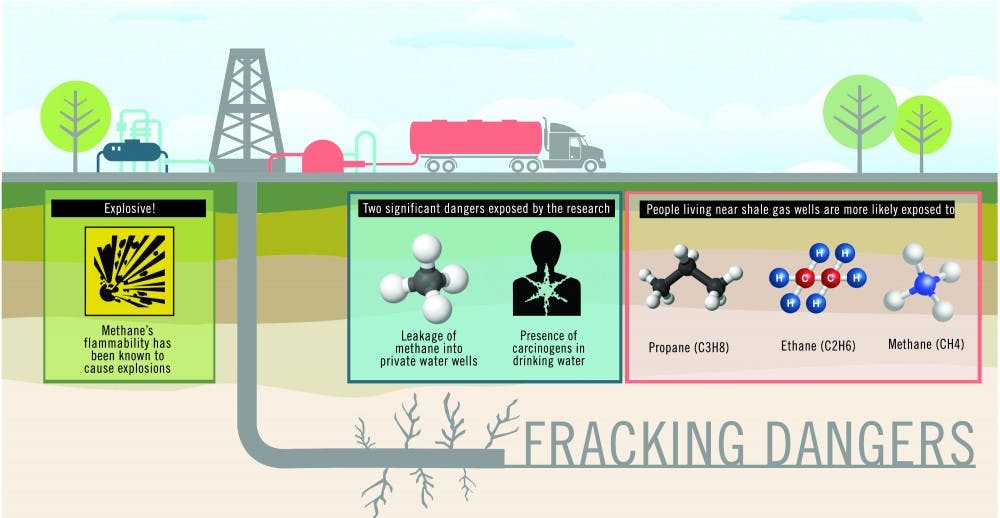

Researchers evaluated data on property sales in Pennsylvania to see whether previously drilled shale-gas wells impacted nearby housing prices. Well water was evaluated due to its often direct contamination from fracking, in contrast with municipally-provided piped water, which is typically less affected. Fracking, a process which uses high-pressure water and horizontal drilling to break up shale beneath the ground and bring up natural gas, has increased the potential to produce domestic oil and gas.

The recently-released study found that even if contamination due to fracking had not occurred, housing values still declined.

“Regardless of whether water contamination is happening, the perception that it might be happening is enough to have large effects on property values,” said Lucija Muehlenbachs, visiting fellow at Resources For The Future, an environmental think-tank, and one of three authors of the study. “The results of the study demonstrated that groundwater contamination risk is calculated into the value of homes that are located near shale gas wells which negatively affects the homeowners by lowering their property value.”

The researchers discovered that the exact distance between a shale well and a house directly affected home prices. For homes that were dependent upon well water, shale wells stationed within one kilometer of the home resulted in a 13.9 percent decrease on average for home value. Additionally, home prices fell by $30,167 for houses within 1.5 kilometers of shale drilling and homes that used piped water gained an average of $4,800 in value when shale wells were opened nearby.

Properties from where the shale-gas wells were not actually visible actually benefited from local shale development in the form of higher home prices. Similarly, neighborhoods with piped water supplies saw higher home values as a result of royalty payments from shale-gas companies.

“This result demonstrates that if we could reduce the contamination risk, homes could benefit from royalty payments without being negatively affected by development,” said Elisheba Spiller, an economist with the Environmental Defense Fund who earned her Ph.D. in economics from Duke in 2011 and one of the authors of the study.

Fracking does have potential benefits, however, in addition to its costs, explained Christopher Timmins, professor of economics and the study’s third author. Shale-gas development emits less carbon per unit of energy than coal, for example, although it poses a greater risk of water contamination and hazardous waste deposits.

The team that authored the study is currently working on a project that focuses on rental rates for housing in Pennsylvania in response to drilling. The conventional theory has been that rental rates increase when there is high demand created by incoming well-workers, Timmins explained.

Despite the consistently low price of natural gas, shale development—which extracts natural has intensified in various countries, including the United States and the United Kingdom. Timmins said that natural gas pricing should be more sensitive to the costs of fracking.

“I would expect the pace to really pick up again in the U.S. if the price of natural gas starts to climb again,” he explained. “It is my opinion that the price of natural gas should reflect to the full cost to society of developing it—if it were to do that, it might not be as cheap as it is today.”

Get The Chronicle straight to your inbox

Signup for our weekly newsletter. Cancel at any time.