Though Duke's endowment reached a record high of $7 billion at the end of the 2014 fiscal year, its high rate of growth will be difficult to maintain in the long-term.

The University reported a 20.1 percent return on its total investments—one of the highest rates in the country—but recognizes that growth will vary from year to year, said Executive Vice President Tallman Trask. With this year showing the endowment at its highest level since the economic crash in 2008, Trask said Duke hopes to continue its growth despite current economic uncertainty.

“The markets are back up, and we’ve ridden them back," Trask said. "DUMAC also did a good job picking stock this year, and that was one of the factors that allowed us to be so successful. Our focus, though, is on long-term growth—that's what we're looking for."

Duke's endowment is managed by DUMAC, a professionally-staffed investment group controlled by the University. The 2014 fiscal year ran from July 1, 2013 to June 30, 2014 and the financial report was released to the Board of Trustees at their meeting last month.

The endowment's value increased by $1 billion from FY 2013 to FY 2014. The year before also saw high growth—reporting a 13.5 percent return on the endowment investments. But Trask said the University does not necessarily expect to consistently post returns this high in future years.

"That’s largely because there’s still a lot of underlying turmoil in the economy both here and elsewhere," Trask said. "We’ve come to the view that we’re going to reduce our expectations given the fluidity of the markets.”

He noted that the endowment's returns were among the highest in the country from the mid-1990s until the recent downturn, with an average annual return of 16 percent—going from $1.8 billion in 1997 to a peak of $6.1 billion in 2008. But when the economy crashed, the endowment dropped by almost 25 percent, falling from the $6.1 billion of FY 2008 to $4.4 billion in FY 2009.

Now, with losses from the financial meltdown completely recouped, Duke and DUMAC can look ahead. Trask cited an overall endowment value of $10 billion as a solid benchmark for the University to aim for in the coming years.

A contributing factor to the endowment's success in FY 2014 was philanthropic giving, Trask wrote in the official 2013-14 Financial Statement. With the University in the middle of the $3.25 billion DukeForward capital campaign, philanthropy hit a record high of $441.8 million in FY 2014.

The year was not only one of high giving but also one of high spending, the statement noted. With significant campus construction ongoing, FY 2014 had the second-highest level of capital spending in the University's history—a total of $221 million.

Endowment's progress on par with peers

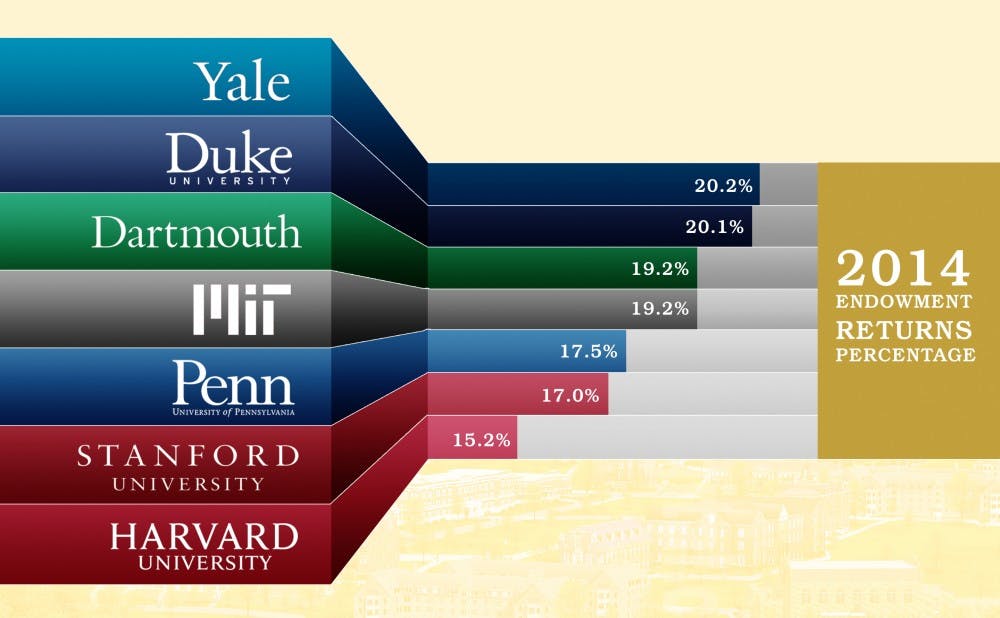

Many of Duke's peer institutions saw similarly high returns on their investments for FY 2014, with most beginning to reach pre-recession levels again.

Yale University led peer schools with a 20.2 percent return. Growth ranged between 15 and 20 percent for Brown University, Columbia University, Dartmouth College, Harvard University, the Massachusetts Institute of Technology, the University of Pennsylvania and Stanford University.

Princeton University and Cornell University have not yet released figures for FY 2014.

The overall value of Duke's endowment is significantly below that of some of its older peers. Trask explained that historically Duke has not competed with Harvard, Yale, Princeton and Stanford in terms of endowment size, and will not in the near future.

"That’s largely because they’re older—Harvard has been building its endowment for the last 200 years," Trask said. "One benefit of having a smaller endowment, however, is that you’re less dependent on it, so we suffered a little less when the market crashed in 2008.”

Though some of the larger endowments—including those of Harvard and Stanford, which have overall values of $36.4 billion and $18.7 billion, respectively—are still below their pre-recession peaks, most of the institutions with comparatively smaller endowments have recovered over the past two years.

As its endowment increases in coming years, the University will see increased opportunities to make socially responsible investments, said Advisory Committee on Investment Responsibility Chair James Cox, the Brainerd Currie professor of law.

Cox said that the University has already made progress—noting that it does not invest in tobacco or arms stock and selects financial managers who seriously consider the types of funds they invest in.

He predicted that Duke and other institutions will soon follow the lead of Yale, which has made a point of investing in green initiatives.

"I'm optimistic about the future," Cox said. "It's possible for universities to make socially responsible decisions with taking on too much risk, and see their returns maximized because of it."

The endowment consists of more than 4,400 individual funds that are invested in a variety of ways—including through public and private equity, real estate and corporate bonds, among other areas.

Nearly a third of the endowment is designated for unrestricted support of the University, with a spending rate approved by the Board of Trustees. An additional 22 percent is specifically earmarked for financial aid, and 19 percent is designated for endowed faculty positions. The remaining funds are used for instruction and research or are restricted.

Get The Chronicle straight to your inbox

Signup for our weekly newsletter. Cancel at any time.